It has been three years since my last visit to Mobile World Congress and the event did not disappoint. The halls were packed, the exhibitor stands were impressive, and one theme stood above all others. AI is everywhere. From network automation to new customer experiences, AI’s influence is inescapable.

Yet, for those tracking the evolution of the Connected Product Economy (IoT), the shift in focus might feel like a signal that its moment has passed. Three years ago, IoT was a dominant theme at MWC. Now, it seems to be playing a quieter role. But that perception is misleading.

While it may not be in the spotlight, IoT remains a growing and essential part of the connectivity and networking ecosystem. Countless exhibitors and attendees are still focused on delivering on the real-world promise of connected products. As connectivity economics grows more challenging, service providers and component suppliers are realizing that value is no longer just about connectivity. Everyone pays lip service to the fact that IoT is an ecosystem - but surprisingly few really understand or speak to the value chain in a connected product. And more importantly, do they understand the value chain in a connected product business. It is the entire operational ecosystem that makes these products and businesses succeed or fail - not just components and connectivity.

The Connectivity Market Evolution

Unsurprisingly, one of the most significant discussions at MWC revolved around connectivity and how enterprises can achieve broader coverage and lower costs. Many conversations focused on advancements such as eSIM technology and the growing presence of satellite coverage into cellular networks. These developments are helping enterprises navigate the complexity of global connectivity and reducing their reliance on fragmented cellular networks.

Despite these advancements, or maybe because of them, ARPU pressure is very real and providers are being squeezed. Most major Mobile Network Operators (MNOs), large and small Mobile Virtual Network Operators (MVNOs) don’t have a good answer. Cellular IoT connections have surpassed one billion LTE-M and NB-IoT devices globally, yet the economics of connectivity continue to be a concern as customers are relentlessly seeking ways to cut costs across the entire lifecycle of their connected products.

Pricing pressure is no longer just about cost per MB. It is about the total cost of ownership. Enterprises are not just evaluating connectivity costs, they are looking at how to optimize reliability and efficiency. This is where connectivity providers have both an opportunity and an obligation to offer more than just connectivity.

The Shift Toward New Enablement Capabilities and Full-Scale Solutions

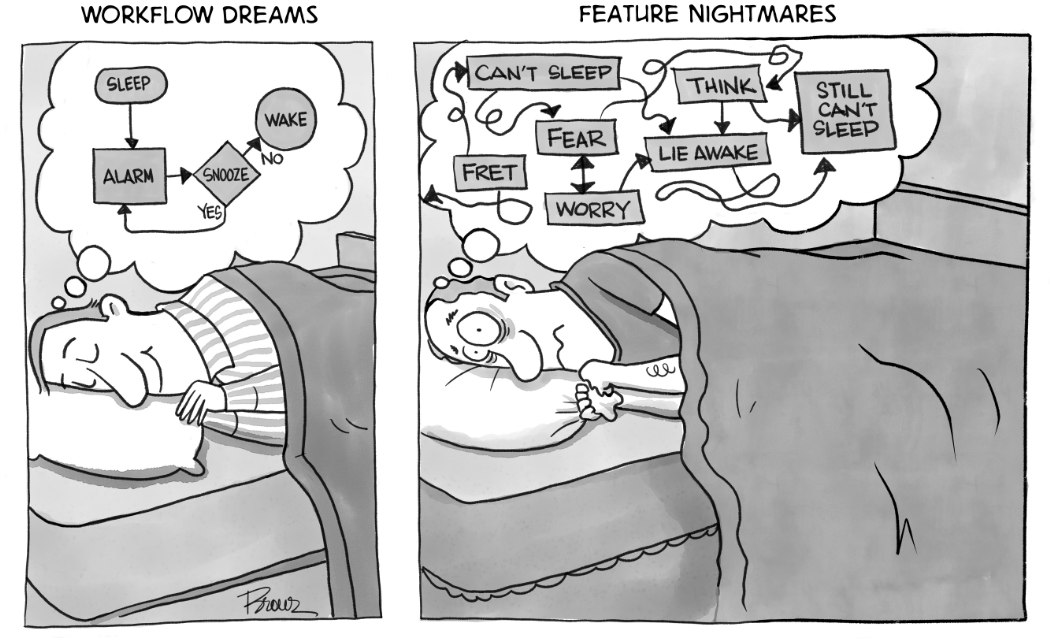

There is an important market shift happening right before our eyes. The economics of pure connectivity are becoming increasingly unsustainable. ARPU (Average Revenue Per User) is declining, competition is driving margins lower, and customers need more than just connectivity to justify long-term investments. Providers who fail to differentiate will find themselves stuck in a race to the bottom, where cost-cutting erodes profitability, service quality and differentiation.

This is where connectivity providers have both an opportunity and an obligation to offer more than just connectivity.

Connectivity providers must evolve beyond the data plan. Customers need ways to manage connectivity, devices, data flows, and more. Service providers are in a prime position to offer richer DeviceOps, Orchestration, and Lifecycle Management software. Doing so makes them stickier and valuable because it will reduce complexity, improve uptime, and deliver business value beyond the MB.

We are already engaging with forward-thinking providers who see this reality unfolding. They see and will seize the opportunity to provide a broader set of services and wrap them into their core connectivity offerings. They are expanding their portfolios to include device and data management and workflow orchestration. This strategy creates new revenue streams and strengthens customer relationships by embedding providers deeper into their customers’ operational models.

Original equipment manufacturers (OEMs) can no longer rely on build-it-yourself approaches to everything in their product stack. They will gladly partner for a richer set of capabilities from trusted and new partners. The question is - who will step up and deliver more of what customers need so they can win - and we all can win in the Connected Economy.

About the Author - Jonathan Greenwood is Vice President, Solution Architecture and Delivery at EdgeIQ and a 20-year veteran of the IoT industry. An early employee at Jasper Wireless (acquired by Cisco), Jonathan helped dozens of Mobile Network Operators create platforms to manage hundreds of millions of IoT devices worldwide. Jonathan also worked for Sierra Wireless (acquired by Semtech) and helped them deliver value-added services, including software and connectivity - to VARs, Integrators and OEMs.